Contents

ToggleAdvertisements

Many have been asking how they can get an urgent loan in Nigeria as the situation of the country is something not to talk about, the good news is that getting an urgent loan is now possible in Nigeria but the bad news is that getting an urgent loan in Nigeria is not for people who can’t payback.

But before we proceed let’s explain what loan is all about as people have been hearing loan loans and loan all the thing but don’t know the full details of what it is.

WHAT A LOAN IS ALL ABOUT

A loan can also be referred to as a mortgage, lending, credit, or overdraft.

A loan as defined by the Oxford dictionary is something borrowed, especially a sum of money that is expected to be paid back with interest.

Advertisements

In finance Wikipedia explained a loan as money lending by one or more individuals, organizations, etc. the recipient been the borrower, now attracts a debt which is usually liable to pay interest on that debt until it is fully repaid as well as to repay the primary amount borrowed or taken.

WHAT IS A LOAN INTEREST?

Loan interest is an incentive been provided to the lender before he or she engages on the loan. Some lenders charge their percentage daily, weekly, or monthly.

Due to some human behaviors, many lenders now accept compulsory collateral before they can provide a loan to the borrower. Let’s explain what loan collateral is………………

WHAT IS LOAN COLLATERAL?

Loan collateral is a property been provided by the borrower or debtor to the lender or the creditor, to secure the loan repayment.

Collateral serves as the lender’s protection.

What do we mean by lenders’ protection?

Advertisements

Lenders protection means, if a loan is not paid, the collateral will now be taken as the replacement to the amount of money or sum of money been borrowed from the debtor.

As we have known what a loan, loan interest, and loan collateral is, let’s explain the process of how to apply and get an urgent loan In Nigeria, as our post title indicates.

HOW TO GET AN URGENT LOAN IN NIGERIA

There are many ways to get an urgent loan in Nigeria, but here we are going to discuss on the best and low-interest loan app that can offer an urgent loan in Nigeria.

The best and low-interest loan in Nigeria is the carbon app

WHAT IS CARBON APP

Carbon app is an instant loan and free digital banking in Nigeria.

Carbon is been founded by

- Chijioke Dozie – Co-founder & CEO

- Ngozi Dozie – Co-founder and managing director

And many more

BENEFIT OF USING THE CARBON APP TO GET A LOAN

- Very easy, and convenient to register

- The loan requirements are normal which anyone can provide

- No request for statement of account

- Fast customer services

- Low interest rate, which is been split in a way that wouldn’t be stressful for one to pay

- Instant transfer to any bank in Nigeria

- You get cash back on interest paid once you repay on time

HOW TO APPLY FOR A CARBON URGENT LOAN

To get a loan from carbon you have to do the following

In order to have full access to apply for a loan, you have to create an account where you submit all the necessary details required such as

Surname

First name

Phone number

Bank verification number (BVN)

ID card (voter’s card, National identification number-NIN, international passport, or a driving license)

And so on.

- Download the Mobile App

Download the mobile app from the Google play store or app store in other to navigate through the app.

- Apply For Your Desired Loan

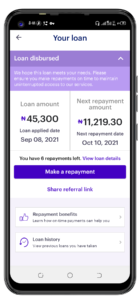

From here you have to input the amount you want to borrow after you have finished submitting your personal details which will be approved within some minutes, then once you have submitted the loan amount it will be reviewed within some seconds or minutes, once approved you can then go ahead to apply.

Note:

I. In order to unlock a higher amount, pay on or before the repayment date

ii. You can top up your loan amount if you have a current three (3) to six (6) months installment and must have paid for 2 months installment on time.

iii. You can also save and bank with carbon as it is now a CBN registered and verified micro-finance bank in Nigeria.

Advertisements

1 thought on “URGENT LOAN IN NIGERIA: FULL DETAILS ON HOW TO GET A MONTHLY INSTALLMENT LOAN IN NIGERIA”