Contents

ToggleAdvertisements

Introduction

In today’s fast-paced world, online banking has become a necessity for many individuals and businesses. Savings Bank of Danbury, founded in 1849, has established itself as a reputable financial institution, offering both stability and modern convenience to its customers. With its headquarters located at 220 Main Street in Danbury and multiple branches in the Greater Danbury area, Southbury, and Waterbury, the bank has made it easier than ever for account holders to manage their finances through their online banking platform. on this blog post, we will explain the step by step guide to savings bank of Danbury login processes

The Benefits of Online Banking

Savings Bank of Danbury’s online banking service provides customers with a range of benefits, allowing them to conveniently and securely handle their financial tasks. By accessing their accounts through the online banking platform, users can monitor their account activity from a centralized location and efficiently manage their finances. Whether it’s checking balances, transferring funds, paying bills, or sending money to friends and family, online banking offers a seamless and time-saving experience.

Check: Savings bank of Danbury locations and operating hours

Savings bank of Danbury login: step-by-step to login

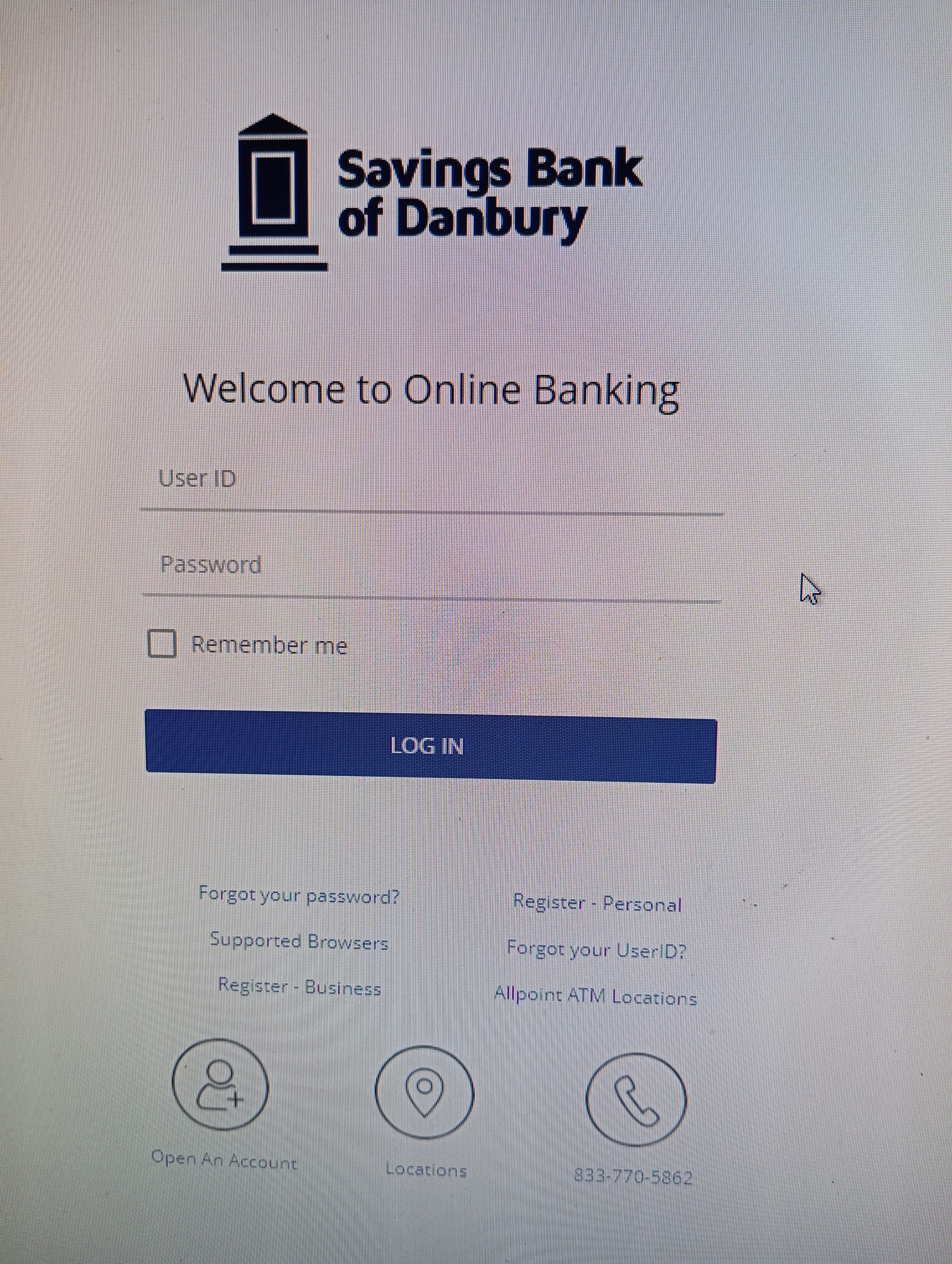

Accessing the online banking service of Savings Bank of Danbury is a simple process. By following these steps, account holders can log in to their accounts:

- Visit the official website of Savings Bank of Danbury by clicking here https://www.sbdanbury.com .

- On the homepage, enter your user ID and password in the designated fields.

- Click the “Login” button to proceed.

Upon submission, the online system will verify your login credentials before granting you access to the platform.

Advertisements

Forgotten Password/Log ID

Forgetting your online banking credentials can be frustrating, but Savings Bank of Danbury offers a straightforward process to reset or recover them. Follow the steps below based on your specific needs:

Reset Forgotten Password

- On the homepage, click on the “Forgot Password?” link.

- Provide your phone number and username in the provided fields.

- Click “Send me a new password.”

After validating your details, the system will send you a new password via the contact information associated with your account.

Recover Forgotten Username

- On the homepage, click on the “Forgot Password?” link.

- Select the option “I forgot my username.”

- Enter your online banking email address.

- Click “Send.”

The system will send your username to the email address associated with your account.

How to Enroll

To take advantage of the convenience of online banking, Savings Bank of Danbury account holders must enroll for the service. The enrollment process is as follows:

- On the homepage, click on the “Register Now” link.

- Fill in the requested details in the Secure Sign Up form.

- Accept the Terms & Conditions.

- Click “Complete Sign up.”

Once your account details are approved by the system, you will be able to set up your online banking credentials.

Managing Your Savings Bank of Danbury Online Account

Once logged in to the online banking platform, account holders gain access to a range of features and functionalities, including:

Advertisements

1. Transfer Funds

Easily transfer funds between your Savings Bank of Danbury accounts or between SBD and other financial institutions. This hassle-free process allows for quick and secure movement of money to meet your financial needs.

2. Online Bill Pay

Take advantage of the online bill payment facility offered by Savings Bank of Danbury. Credit cards, debit cards, and internet banking payments are all accepted, providing a convenient way to manage and settle your bills.

3. Schedule Bill Payments

With online banking, you can schedule one-time or recurring bill payments, ensuring that your bills are paid on time and without the hassle of manual processing. Stay on top of your financial obligations effortlessly.

4. Popmoney®

Send money to anyone, anywhere with the Popmoney® feature. Whether it’s paying back a friend for lunch or sending money to a family member in need, this secure and efficient service makes transferring funds a breeze.

5. Dashboard View

Gain a comprehensive overview of all your accounts with the dashboard view. Monitor your balances, transactions, and account activity from a single, convenient location.

Federal Holiday Schedule

Savings Bank of Danbury follows the same federal holiday schedule as the Federal Reserve Bank. On these holidays, the bank and other financial institutions are closed. Here is the holiday schedule for 2023 and 2024:

Holiday | 2023 | 2024

————————————————————————————

New Year’s Day | January 2 | January 1

————————————————————————————

Martin Luther King Day | January 16 | January 15

————————————————————————————

Presidents Day | February 20 | February 19

————————————————————————————

Memorial Day | May 29 | May 27

————————————————————————————

Juneteenth Independence Day | June 19 | June 19

————————————————————————————

Independence Day | July 4 | July 4

————————————————————————————

Labor Day | September 4 | September 2

————————————————————————————

Columbus Day | October 9 | October 14

————————————————————————————

Veterans Day | November 10 | November 11

————————————————————————————

Thanksgiving Day | November 23 | November 28

————————————————————————————

Christmas Day | December 25 | December 25

savings bank of Danbury customer service

In case you encounter any issues or have questions regarding your Savings Bank of Danbury online banking experience, customer support is readily available. You can reach out to them through the following channels:

- Phone: (203) 743-3849

- Email: [email protected]

Conclusion

Savings Bank of Danbury’s online banking service empowers account holders to conveniently and securely manage their finances from anywhere, at any time. With features like fund transfers, online bill pay, Popmoney®, and a comprehensive dashboard view, the online banking platform offers unparalleled convenience and control. By following the simple login process and exploring the various functionalities, users can unlock the full potential of online banking with Savings Bank of Danbury. Stay on top of your financial goals and experience the ease of digital banking today.

Frequently Asked Questions (FAQs)

Q1: Can I access Savings Bank of Danbury’s online banking from my mobile device?

Yes, Savings Bank of Danbury’s online banking platform is mobile-friendly, allowing you to access your accounts and perform transactions conveniently from your smartphone or tablet.

Q2: Is online banking with Savings Bank of Danbury secure?

Yes, Savings Bank of Danbury employs robust security measures to ensure the safety and privacy of your online banking experience. The platform utilizes encryption technology and multi-factor authentication to protect your sensitive information.

Q3: Are there any fees associated with online banking?

Savings Bank of Danbury’s online banking service is generally free of charge for account holders. However, certain services, such as wire transfers or expedited bill payments, may incur fees. It is recommended to review the bank’s fee schedule or contact customer support for specific details.

Q4: Can I view my statements and transaction history online?

Absolutely. With Savings Bank of Danbury’s online banking platform, you can access your account statements and transaction history at your convenience. Simply navigate to the appropriate section within the platform to view and download your financial records.

Q5: What should I do if I suspect unauthorized activity on my account?

If you believe there is unauthorized activity on your Savings Bank of Danbury online banking account, it is crucial to contact customer support immediately. They will guide you through the necessary steps to secure your account and investigate any fraudulent transactions.

Remember, online banking offers convenience and efficiency, but it is essential to practice good cyber security habits, such as using strong passwords, regularly monitoring your accounts, and avoiding suspicious emails or links. Stay vigilant to ensure a safe and seamless online banking experience with Savings Bank of Danbury.

Advertisements