Contents

ToggleAdvertisements

Introduction

Learn how to open Opay account easily and conveniently. Follow our step-by-step guide on How to open Opay account with or without BVN hassle. Enjoy fast, secure, and affordable financial transactions with Opay’s versatile mobile money platform

What is Opay?

Opay, launched in 2018, is a mobile payment and financial services platform in Nigeria. It offers various services like mobile payments, money transfers, bill payments, airtime and data purchases. With its user-friendly app, competitive pricing, and wide range of services, Opay has gained popularity in Nigeria. So, let’s dive in and explore how to open Opay account on your mobile phone!

Benefits of Opening an Opay Account

Embracing an Opay account comes with a host of enticing benefits, making it a preferred choice for many users. Here are some of the advantages you can relish by opening an Opay account:

1. Convenience at Your Fingertips

With Opay, convenience is redefined. You can effortlessly conduct various financial transactions using your mobile device, eliminating the need to visit physical banks or ATMs. The ease of access makes Opay an attractive alternative to traditional banking methods.

2. Fast Transactions

Time is of the essence, and Opay understands that. Transactions on the platform are processed with remarkable speed, enabling users to complete their financial endeavors in a matter of seconds. This swiftness sets it apart from the often time-consuming procedures associated with conventional banking.

Advertisements

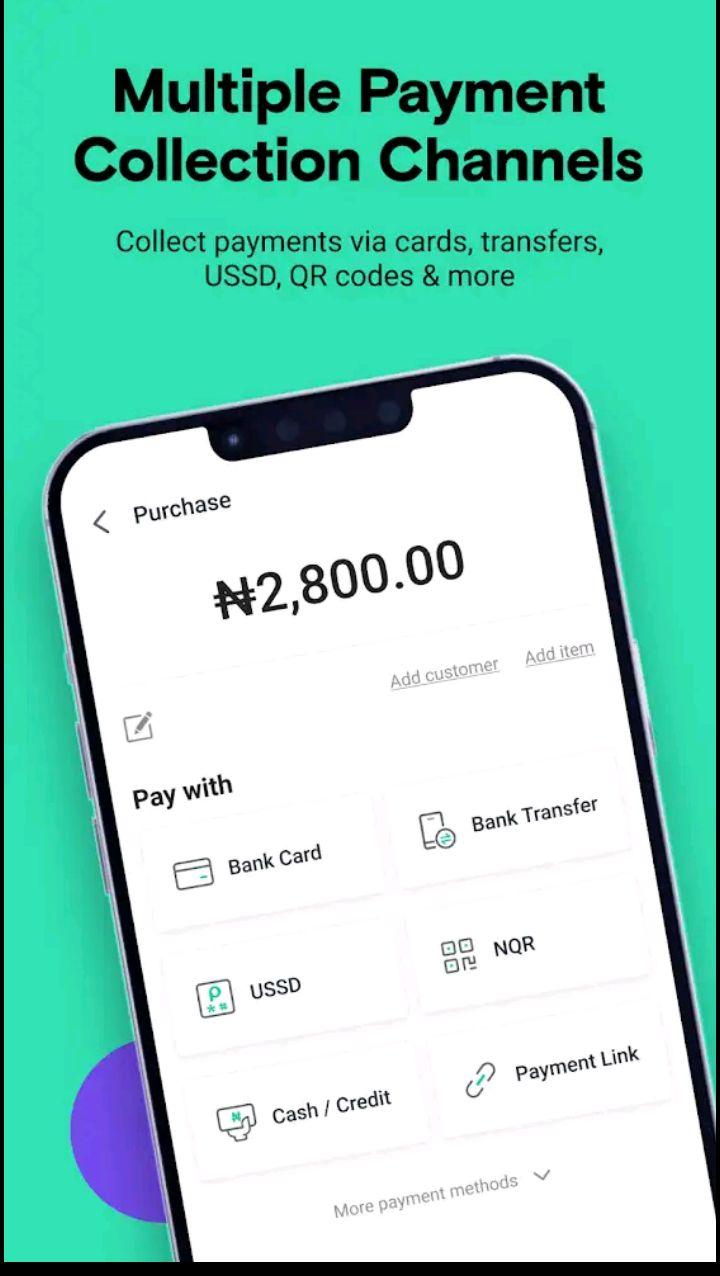

3. Wide Range of Services

Opay doesn’t stop at just one service; it offers a diverse range of financial solutions. From seamless mobile money transfers to hassle-free bill payments and quick airtime purchases, Opay covers a broad spectrum of financial needs. This versatility makes it an all-in-one platform for your financial requirements.

4. Enhanced Security Measures

Your peace of mind matters, and Opay ensures it through robust security measures. The platform employs multiple layers of protection, including encryption and biometric authentication, to safeguard your transactions and personal information. This proactive approach significantly reduces the risk of fraudulent activities.

5. Low Transaction Fees

Cost-effectiveness is a hallmark of Opay. The platform charges minimal to no fees for various transactions, making it a pocket-friendly choice for users. This affordability opens up a world of financial possibilities without the burden of excessive charges.

Embrace the future of finance with Opay and unlock a world of convenience, speed, security, low fees, and versatility. Open an Opay account today to experience the power of cutting-edge mobile financial services

Opay Account Opening Requirements

Before you dive into the OPay sign-up process, let’s take a moment to review the essential requirements to ensure a seamless experience:

1. Smartphone with Internet Access

To access the OPay platform, you’ll need a smartphone with an internet connection. This will enable you to download the app and conduct various financial transactions at your convenience.

Advertisements

2. Personal Information

Prepare your personal information, including a valid email address. This information will be necessary for account registration and communication purposes.

3. Bank Verification Number (BVN)

To successfully open OPay account, you’ll need your Bank Verification Number (BVN). This unique 11-digit number is a crucial part of the registration process and helps authenticate your identity.

4. A Clear Selfie (optional)

While it’s optional, having a clear selfie ready can be beneficial during the verification process. Some users may find it helpful to provide an additional layer of identity confirmation.

Please Note: that during the account opening process, a verification code will be sent to your registered phone number. You’ll need to enter this code to verify your account successfully.

For a quick and basic on how to open OPay account, these are the fundamental requirements. However, if you wish to upgrade your OPay account and gain access to additional features, you may need to fulfill other verification requirements, such as providing an ID card in addition to your BVN.

Rest assured, OPay takes data privacy seriously and adheres to Nigeria’s data protection regulations. Your personal information will be handled with utmost confidentiality and security throughout your OPay journey.

How to Open Opay Account

So, you’re interested to know how to open Opay account, huh? Well, you’ve come to the right place! I’m here to guide you through the process and make sure you don’t miss a beat. Opening an Opay account is pretty straightforward, but I’ll still give you a step-by-step guide because, hey, who doesn’t love some extra guidance?

Step 1: Download The Opay App

First things first, you’ll need to download the Opay app on your phone. Go to your app store or Google Playstore for Android users, search for Opay, and hit that download button. Easy peasy, right?

Step 2: Provide Your Personal Information

Now that you’ve got the app, it’s time to get personal. You’ll need to enter your name, phone number, email address, and create a password. Oh, and don’t forget to use this cool referral code: 8060079245.

Entering the code makes you eligible to receive a welcome bonus. How exciting!

Step 3: Verify Your Account

After providing your personal information, you’ll receive a verification code via SMS. Enter the code in the provided field to prove that you’re not a robot. If you don’t receive the code immediately, don’t panic. Just politely ask for it to be sent again. Patience is a virtue, my friend.

Step 4: Set Up Your Opay Wallet

Congratulations on passing the verification stage! Now, it’s time to set up your Opay wallet. You’ll be asked to create a six-digit PIN that you’ll use to authorize transactions on the platform. Make sure to choose a strong PIN that you’ll remember easily. And no, “123456” is not a strong PIN. Nice try, though.

Step 5: Add Funds To Your Account

Your Opay wallet is like a hungry little piggy bank waiting to be fed. To make it happy, you’ll need to add funds. You can do this by linking your bank account or using your debit card to make a deposit. Follow the instructions provided, and voila! Your wallet will be full and ready to go.

Step 6: Start using your Opay account

Okay, now comes the fun part. With your Opay account all set up, you can start using it to make transactions. Pay bills, shop online, transfer money, and so much more. The possibilities are endless!

See? Opening an Opay account is a piece of cake. Just follow these steps, and you’ll be an Opay expert in no time. But hey, don’t stop here. I’ve got some extra tips for you to make the most out of your Opay experience. Stay tuned for more exciting information, my friend!

Tips for Using Opay

So, you’ve successfully opened an Opay account, congratulations! Now it’s time to make the most out of this fantastic payment platform. Here are some tips to help you navigate through the Opay world with style and grace. Well, as much grace as one can have when dealing with financial transactions.

1. Set Up Recurring Payments

Who has the time to remember paying bills every month? Opay provides the convenience of setting up recurring payments for your regular bills. By doing so, you can save time and avoid missing any payments, ensuring a smooth and hassle-free financial routine.. How convenient!

2. Add Multiple Payment Methods

because variety is the spice of life.

By linking different payment methods to your Opay account, like your bank account or other payment platforms, your can enjoy the flexibility of choosing how to pay for your transactions. It’s like having a buffet of payment options at your fingertips!

3. Check your account balance regularly

Cultivate the habit of regularly checking your Opay account balance. Consistent monitoring empowers you to stay informed about your expenses and ensures sufficient funds for seamless transactions.. Plus, it helps you avoid any unpleasant surprises when making transactions. No one wants to be surprised by an empty wallet, right?

4. Use Opay for online shopping

Opay offers seamless online shopping experiences. Look for the Opay payment option during your online purchases and simply follow the provided instructions to shop with ease.

So, there you have it – some handy tips for using Opay effectively. Now go out there and conquer the world of mobile payments with your newfound knowledge. And remember, with Opay, life is just a little bit easier, one transaction at a time. Happy spending!

Common Issues With Opay Wallet and How to Solve Them

So, you’ve set up your Opay account and you’re all excited to start using it for all your financial transactions. But wait, what’s this? You’re facing some issues with your Opay wallet? Don’t worry, you’re not alone! Here are the common issues faced by Opay users and how you can solve them.

1. Trouble registering for an Opay account

Did you have a hard time registering for an Opay account? Well, it happens to the best of us. The first thing you should do is double-check if you have entered all your personal information correctly. If that’s not the issue, you can contact Opay support for assistance. They’ll be more than happy to help you out.

2. Problems Adding Funds To Your Account

Oops! Are you unable to add funds to your Opay wallet? That can be frustrating, I know. First, make sure that you have linked your bank account or debit card correctly. If everything seems to be in order, contact Opay support to troubleshoot the issue further. They’ll get you sorted in no time.

3. Issues With Account Verification

Ah, the famous account verification hurdle! If you’re having trouble verifying your Opay account, the first thing you should do is check if you entered the verification code correctly. If it still doesn’t work, request for another verification code. If the problem persists, reach out to Opay support for assistance. They’ll guide you through the verification process.

Remember, even with the best platforms, issues can arise. But with Opay’s dedicated support team, you don’t have to worry.

They are there to assist you with any problems you might encounter. So, stay calm, reach out to them, and get ready to enjoy the convenience and benefits of using Opay for all your financial needs.

How To Open Opay Account With USSD Code

Opay, the leading financial services platform, offers a simple and efficient way to open an account using a USSD code – *995#. This code is compatible with all major Nigerian networks, including Mtn, Glo, Airtel, and 9mobile.

To get started, all you need to do is dial *995# on your mobile phone. Once dialed, a link will be sent to your device, enabling you to install the Opay app and create an account. During the registration process, make sure to enter the Referral Code 8060079245 to receive an exclusive ₦1200 bonus after adding money to your account.

Once your Opay account is successfully opened through the app, you can conveniently make transactions using the *995# USSD code. This feature provides a hassle-free alternative to using the app for most of your financial needs.

Embrace the ease and efficiency of Opay’s services today by opening an account and enjoying seamless transactions through the *995# USSD code. Simplify your financial activities with Opay, your trusted financial partner

Check here if you want to borrow money from opay through okash loan app

Opay Account Opening – FAQs

Are you ready for some FAQs about opening an Opay account? Well, buckle up because I’ve got all the answers you need. Let’s dive in and clear up any doubts you may have.

Is Opay approved by CBN?

Absolutely! Opay is 100% approved by the Central Bank of Nigeria (CBN). So, you can trust them with your financial transactions and rest assured that they comply with all the necessary regulations.

Is it free to create an Opay account?

Yes, my friend, it won’t cost you a dime to open your Opay account. It’s absolutely free of charge. So, go ahead and sign up without worrying about any hidden fees.

What is the bonus for opening an Opay account?

Well, my curious friend, the bonus for opening an Opay account is the wonderful world of convenience at your fingertips. When you open an Opay account using a valid referral code, you will receive a cashback bonus of 1,200 Naira as a special reward

What are the requirements for creating an Opay account?

To open Opay account requires providing your name, phone number, email address, and setting up a password. To complete the process, verify your account by entering the verification code sent to your phone number.

Can I Open Opay Account Without BVN?

Oh yes you can open opay account without BVN but there is a limit. Click here To know how to open opay account without BVN

How to open Opay account online?

Opening an Opay account online is a breeze! Just download the Opay app from the Google Play Store or App Store, follow the easy-peasy steps I mentioned earlier, and voila! You’re all set to start using Opay’s wonderful services.

Can I link multiple payment methods to my Opay account?

Absolutely! Opay allows you to link multiple payment methods to your account. It’s like having a wallet full of cards – you can choose which one to use for each transaction. How convenient is that?

How do I add funds to my Opay wallet?

Adding funds to your Opay wallet is a piece of cake. You can link your bank account or use your debit card to make a deposit. Just follow the instructions provided, and ka-ching! Your wallet will be filled with digital riches.

How do I set up recurring payments on Opay?

Setting up recurring payments on Opay is a brilliant way to save time and ensure that you never miss a payment. Just find the option to set up recurring payments in the app, choose the bills you pay regularly, and let Opay handle the rest. It’s like having a personal assistant for your finances.

Can I use Opay for international transactions?

Oh, I’m sorry to burst your international bubble, but Opay is currently only available for transactions within Nigeria. So, for now, you’ll have to stick to domestic transactions. But hey, who knows what the future holds?

What should I do if I encounter issues when using Opay?

Fear not, my friend! If you encounter any issues while using Opay, just reach out to their lovely support team. They’ll be more than happy to assist you and resolve any problems you may face. They’re like fairy godmothers for your financial troubles.

And there you have it, folks! All your burning questions about opening an Opay account answered. Now go forth, sign up, and embrace the world of hassle-free financial transactions. Happy Opaying!

Conclusion

So there you have it, folks! To Open Opay account is as easy as pie. Just follow the simple steps outlined in this guide and you’ll be up and running in no time. From downloading the app to adding funds to your account, we’ve covered it all.

But wait, there’s more! We’ve also shared some great tips to help you make the most out of your Opay account. Set up recurring payments, add multiple payment methods, and check your account balance regularly. And hey, don’t forget to use Opay for all your online shopping needs!

Of course, like with any platform, there may be some hiccups along the way. But fear not, we’ve got you covered with solutions to common issues you may encounter.

So what are you waiting for? Open Opay account today and enjoy the convenience, speed, and security it offers. Happy banking, folks!

Advertisements

3 thoughts on “How to Open Opay Account through Mobile App or USSD code: Best Guide”