Contents

ToggleAdvertisements

Introduction

In recent years, online loan companies have revolutionized the borrowing landscape in Nigeria. One such company is Okash, a subsidiary of Opay, which offers quick and convenient loans to individuals in need of financial assistance. If you’re considering to borrow money from opay or okash, you may be wondering how much you can borrow and what the process entails. In this comprehensive guide, we’ll explore everything you need to know about borrowing from Okash loan app, including the loan application process, eligibility requirements, interest rates, repayment options, and more.

Understanding Okash and Opay

Before diving into the details of borrowing from Okash loan app, it’s important to understand the relationship between Okash and Opay. Opay is a mobile-based platform that offers a wide range of services, including payment solutions, transportation services, food and grocery deliveries, and more – click here to open opay account . Okash, on the other hand, is the lending arm of Opay, providing individuals with access to quick and convenient loans. By leveraging the power of technology, Okash has made borrowing money in Nigeria easier than ever before.

How to Borrow Money from Okash

The first step in borrowing money from Okash is to download the Okash app on your smartphone. Once you’ve downloaded the app, you’ll need to sign up using your mobile number. The registration process is simple and straightforward, requiring you to provide basic personal information. Once you’ve completed the registration process, you’ll have access to the loan application feature within the app.

To apply for a loan from Okash, simply navigate to the loan section of the app and follow the prompts. You’ll be asked to input the desired loan amount and select the loan duration. It’s important to carefully consider the amount you borrow and the repayment period to ensure that you’ll be able to comfortably repay the loan within the specified timeframe. Once you’ve submitted your loan application, the Okash team will review your request and inform you of the outcome.

Eligibility Requirements for Okash Loans

To be eligible for a loan from Okash, you must meet certain requirements. These requirements may vary slightly depending on the specific loan product you’re applying for. Generally, the eligibility criteria for Okash loans include:

Advertisements

1. Nigerian residency: You must be a resident of Nigeria to apply for an Okash loan.

2. Age criteria: Okash typically requires borrowers to be between the ages of 20 and 55 years old.

3. Source of income: You’ll need to have a steady source of income or provide a valid reason for needing the loan.

4. Identification: You’ll be asked to provide a valid ID card for verification purposes.

5. BVN number: Okash may require you to provide your BVN (Bank Verification Number) for identity verification.

Advertisements

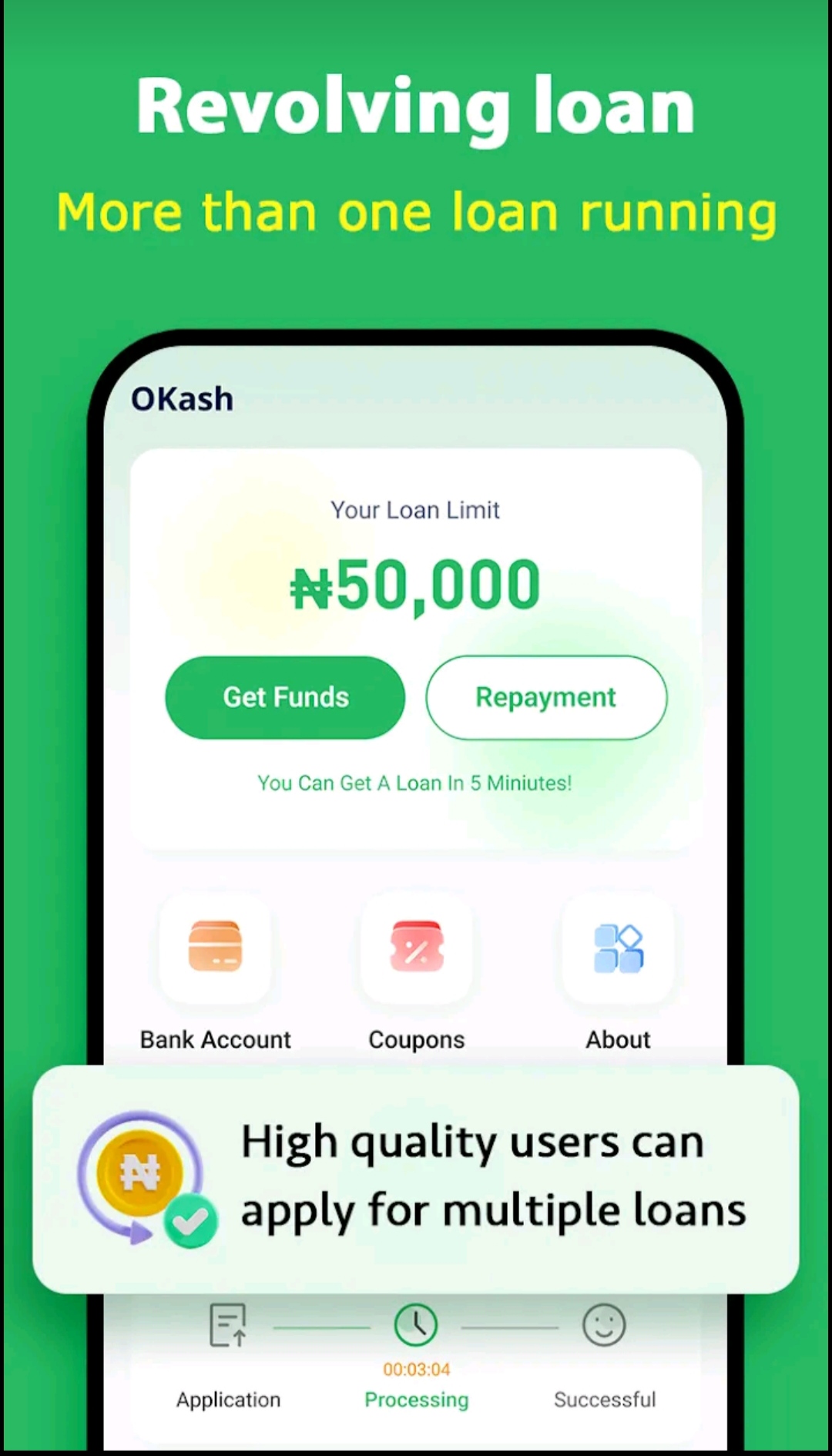

Maximum and Minimum Loan Amounts

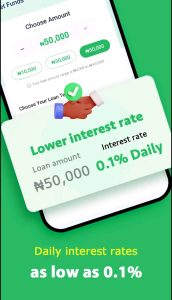

Okash offers a range of loan amounts to cater to different borrowing needs. The maximum and minimum loan amounts you can borrow from Okash vary depending on factors such as your creditworthiness and repayment history. Generally, the maximum loan amount is set at ₦50,000, while the minimum loan amount is ₦3,000. It’s important to note that these amounts are subject to change based on Okash’s lending policies and regulatory requirements.

Interest Rates and Fees

When borrowing from Okash, it’s crucial to understand the interest rates and fees associated with the loan. Okash charges a daily interest rate ranging from 0.1% to 1%, depending on the loan product and repayment period.

The annual interest rate for Okash loans falls between 36.5% and 360%. In addition to the interest rate, Okash may charge an origination fee, which typically ranges from ₦1,299 to ₦6,000. It’s important to carefully review the terms and conditions of the loan before accepting it to ensure you understand the total cost of borrowing.

Repayment Options

Okash offers flexible repayment options to accommodate borrowers’ financial situations. Once your loan is approved, you’ll receive a repayment schedule outlining the due dates and amounts.

Okash offers various repayment methods, including automatic deductions from your bank account, repayment through the Okash app, or repayment through the Okash USSD code. It’s important to ensure you have sufficient funds in your bank account on the due dates to avoid late payment fees or penalties.

Okash Loan USSD Code

If you prefer to borrow money from Okash using a USSD code, you’re in luck. Okash provides a convenient USSD code that allows you to access loan services directly from your mobile device. To borrow money using the Okash USSD code, follow these steps:

- Dial *955# using the phone number registered with your Okash account.

- Select the “loans” option from the menu.

- Follow the on-screen prompts to apply for the loan amount eligible for you.

- Once your loan is approved, the funds will be credited to your account.

Customer Reviews

It’s always helpful to hear from other borrowers about their experiences with Okash loans. Here are a few customer reviews to provide you with some insights:

Positive Reviews in Google playstore:

Celestine nweke.: The App is interesting so far, there approach and relationship to customer is more professional than the

rest. Simple to use and reliable. As it the best online

money lending app that gives high amount with the

longest repayment time! Pls work on your interest rate

for those that have been consistent in borrowing and

repaying as at when due

Klein Leonard: This is awesome experience, it’s my first time, though

the loan approved is small compared to what | expect.

But I’m amazed at the speed of disbursement, very low

interest and long term repayment. Thank you Okash,

but | need bigger amount next time.

Negative Reviews in Google playstore:

Feco: It’s a good app | would say, but | have been trying to

apply for a loan for over 2 weeks now. Whenever | apply,

| get a message that says “keep better credit records

and try again in five days time” which has occurred

three consecutive times now . | have always paid on

time, never left a loan overdue and I’m getting that

kinda feedback from the app. It’s really frustrating..

Please | would like the management to work on that or |

would have to look for another loan app, thanks.

Esther uwaoma: It’s a great app…loans are disbursed on time most

times within five minutes There’s no much hassle of

registration when applying for a loan. Most importantly,

there’s enough time to pay back the loan. However, the

interest rate is a little high, could you please look into it?

I’m hoping to rate this five stars soon enough….

Conclusion

Borrowing money from Okash can provide a quick and convenient solution to your financial needs. By following the simple application process and meeting the eligibility requirements, you can access loans ranging from ₦3,000 to ₦50,000, depending on your creditworthiness. It’s important to carefully review the terms and conditions, including the interest rates and fees, before accepting a loan. With flexible repayment options and an easy-to-use app, Okash loan offers a reliable lending solution for individuals in Nigeria. Remember to borrow responsibly and only take on loans that you can comfortably repay within the specified timeframe.

Advertisements